Antikythera Mechanism. I don't know how to pronounce it but its really quite cool. The original one was found in the ocean near Greece. I first learned about the original device a few years ago and it was still a mystery as to what it did. Seems like they have got it figured out. Anyway the lego video below shows how the device worked. and its pretty cool as well.

Monday, December 10, 2012

Thursday, November 15, 2012

Sunday, November 4, 2012

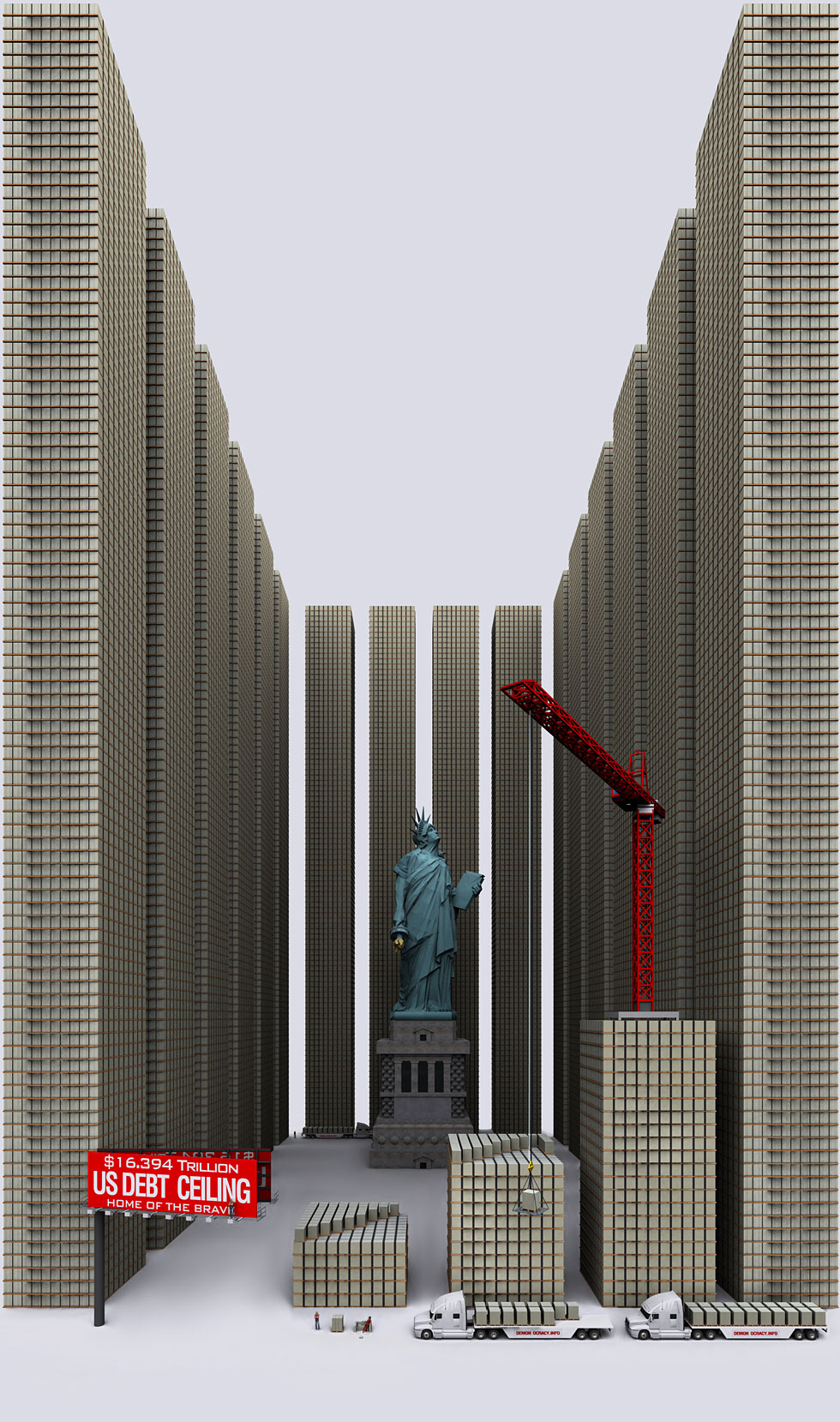

| US Debt Visualized in $100 Bills |

| United States owes a lot of money. As of 2012, US debt is larger than the size of the economy. The debt ceiling is currently set at $16.394 Trillion. |

| One Hundred Dollars |

| $100 - Most counterfeited money denomination in the world. Keeps the world moving. |

| Ten Thousand Dollars |

| $10,000 - Enough for a great vacation or to buy a used car. Approximately one year of work for the average human on earth. |

| One Million Dollars |

| $1,000,000 - Not as big of a pile as you thought, huh? Still this is 92 years of work for the average human on earth. |

| One Hundred Million Dollars |

| $100,000,000 - Plenty to go around for everyone. Fits nicely on an ISO / Military standard sized pallet. The couch is worth $46.7 million. Made out of crispy $100 bills. |

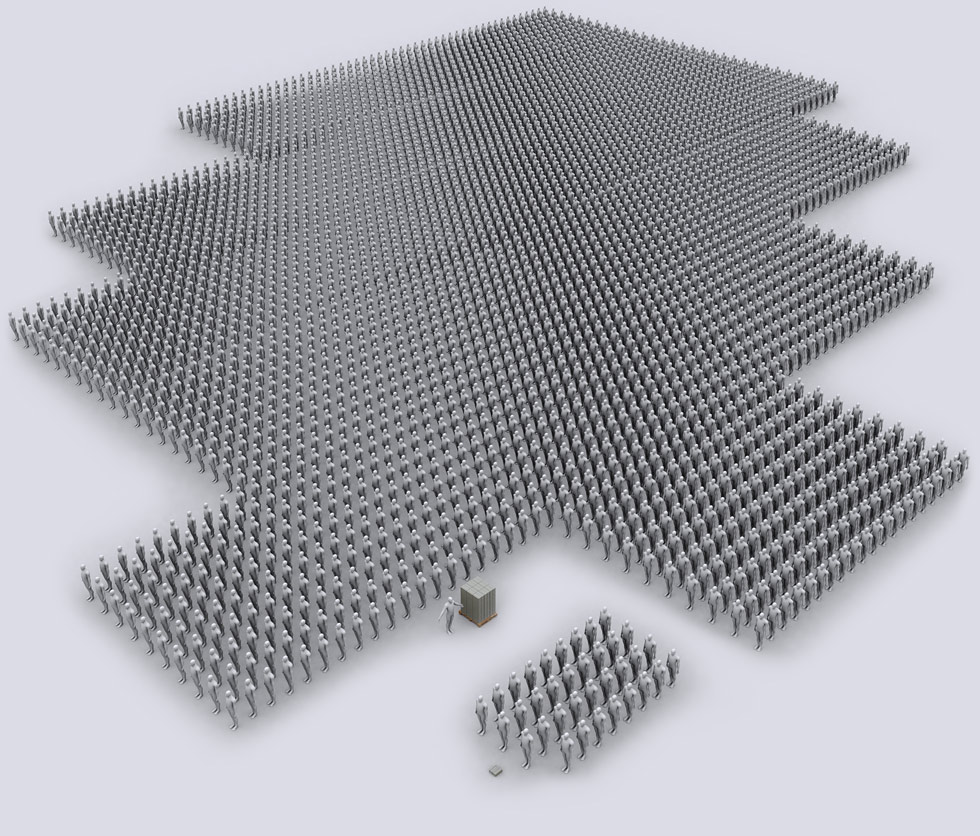

| $100 Million Dollars = 1 year of work for 3500 average Americans |

| It takes 3500 Americans 1 year of work to make $100 Million dollars. The 155 million Americans who worked with earnings in 2005 on average made $28,567 / year. In front of the 3500 people is the $100 Million pallet that they all have to work for 1 year to earn. Look carefully to see a stack of $1 Million and the 35 average Americans required to earn that $1 Million in 1 year. |

| One Billion Dollars |

| $1,000,000,000 - You will need some help when robbing the bank. Interesting fact: $1 million dollars weights 10kg exactly. You are looking at 10 tons of money on those pallets. |

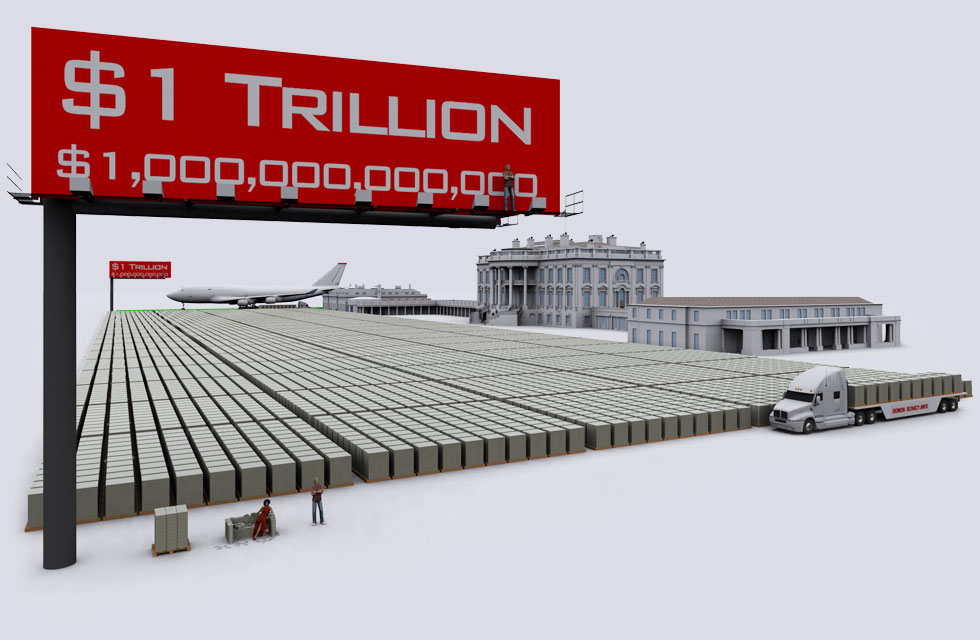

| One Trillion Dollars |

| $1,000,000,000,000 The 2011 US federal deficit was $1.412 Trillion - 41% more than you see here. If you spent $1 million a day since Jesus was born, you would have not spent $1 trillion by now... but ~$700 billion- same amount the banks got during bailout. |

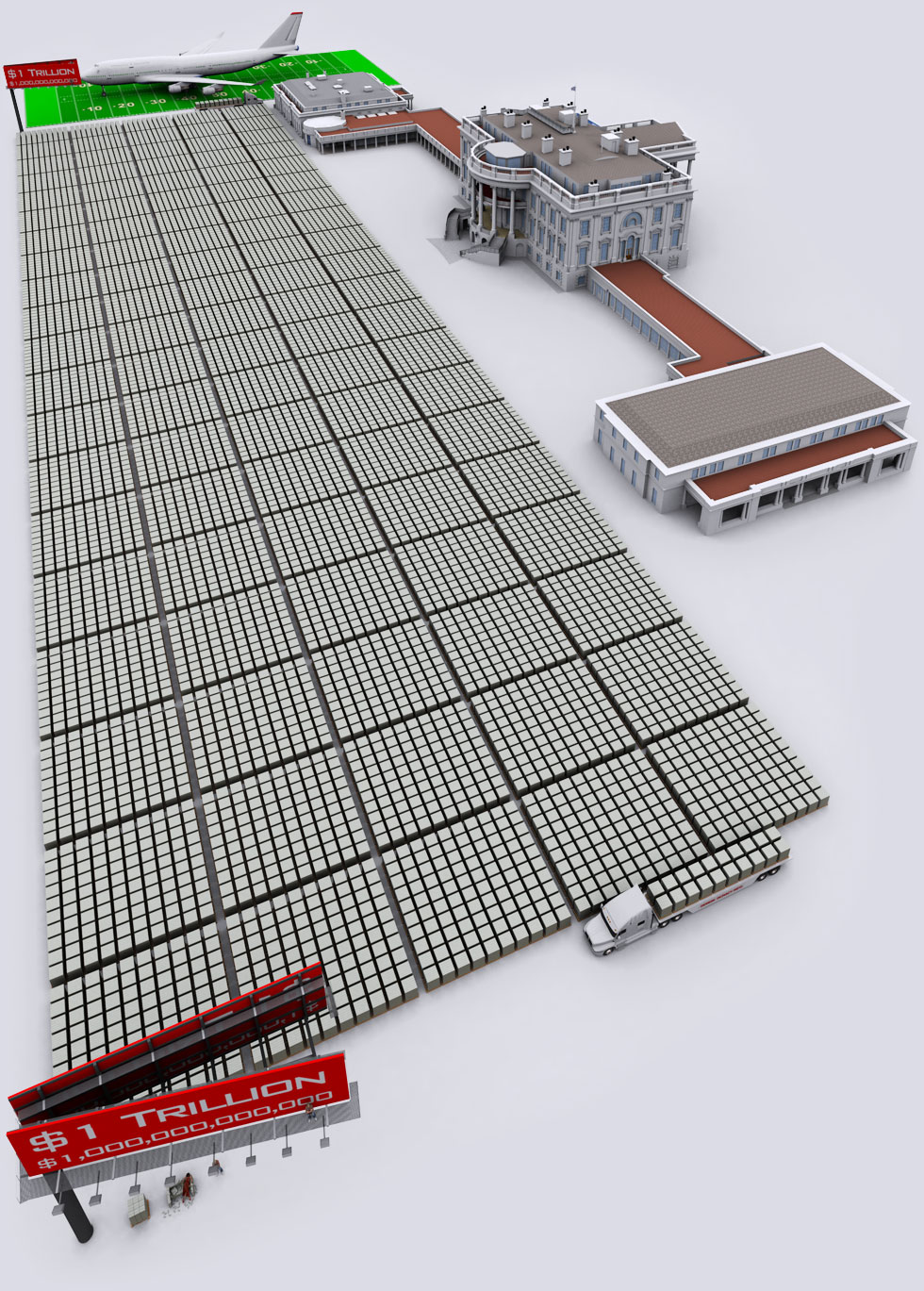

| One Trillion Dollars |

| Comparison of $1,000,000,000,000 dollars to a standard sized American Football field. Say hello to the Boeing 747-400 transcontinental airliner that's hiding in the back. This was until recently the biggest passenger plane in the world. You can see the White House with both wings to the right. "My reading of history convinces me that most bad government results from too much government." - Thomas Jefferson |

| $16.394 Trillion - 2012 US Debt Ceiling |

| The US debt ceiling limit D-Day is estimated for September 14, 2012. US Debt has now surpassed the size of US economy in 2011-- rated @ $15,064 Trillion. Statue of Liberty seems rather worried as United States national debt is soon to pass 20% of the entire world's combined economy (GDP / Gross Domestic Product). “I predict future happiness for Americans if they can prevent the government from wasting the labors of the people under the pretense of taking care of them.” - Thomas Jefferson |

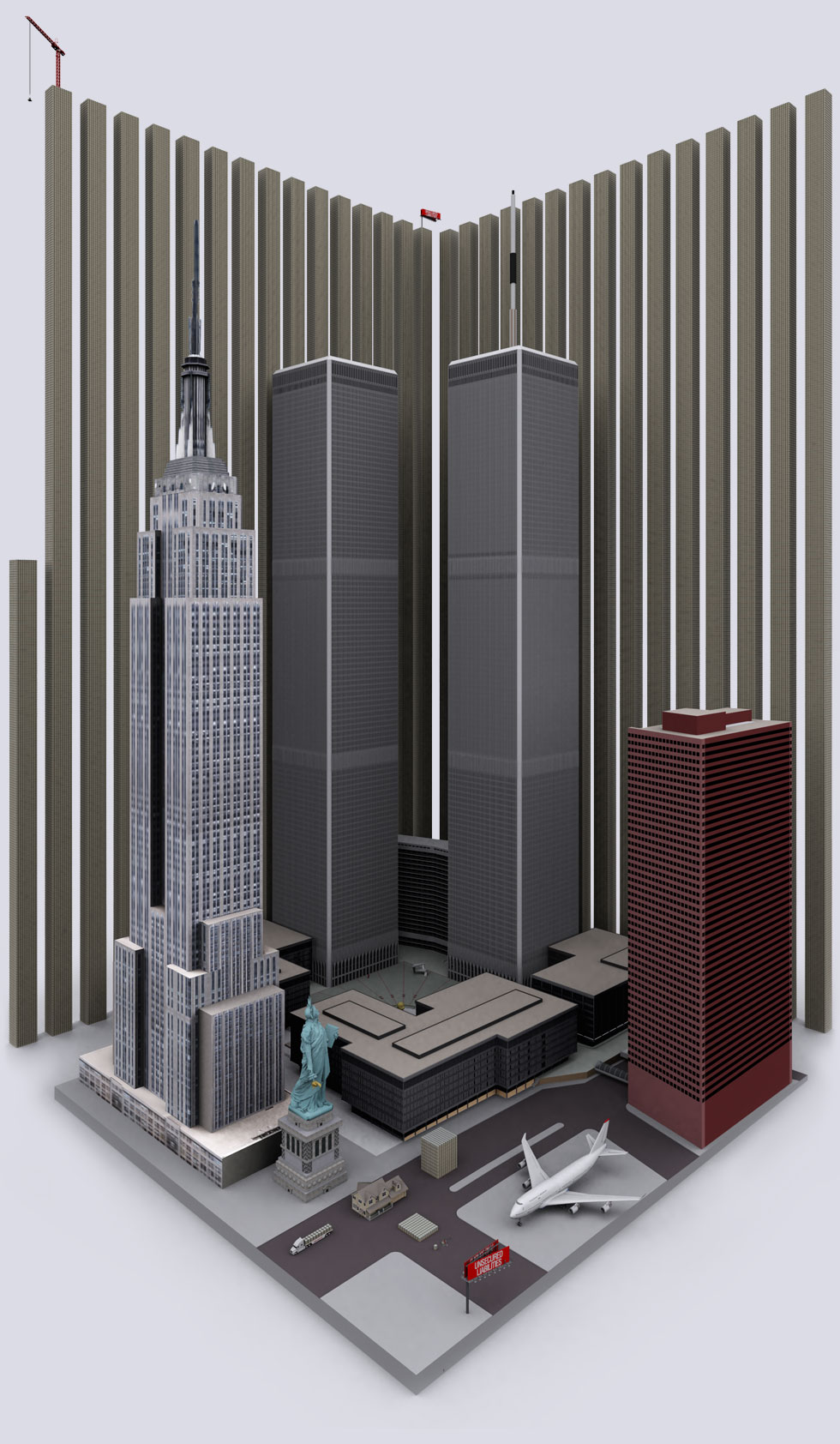

| 122.1 Trillion Dollars |

| $122,100,000,000,000. - US unfunded liabilities by Dec 31, 2012. Abovet you can see the pillar of cold hard $100 bills that dwarfs the WTC & Empire State Building - both at one point world's tallest buildings. If you look carefully you can see the Statue of Liberty. The 122.1 Trillion dollar super-skyscraper wall is the amount of money the U.S. Government knows it does not have to fully fund the Medicare, Medicare Prescription Drug Program, Social Security, Military and civil servant pensions. It is the money USA knows it will not have to pay all its bills. If you live in USA this is also your personal credit card bill; you are responsible along with everyone else to pay this back. The citizens of USA created the U.S. Government to serve them, this is what the U.S. Government has done while serving The People. The unfunded liability is calculated on current tax and funding inputs, and future demographic shifts in US Population. Note: On the above 122.1T image the size of the bases of the money stacks are $10 billion, and 400 stories @ $4 trillion "It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world." - Thomas Jefferson Everyone needs to see this. Source: Federal Reserve & www.USdebtclock.org - visit it to see the debt in real time and get a better grasp of this amazing number. |

Friday, November 2, 2012

Monday, October 22, 2012

Wednesday, October 10, 2012

Friday, September 28, 2012

Israeli leaders meet Ahmadinejad in NYC

The more i learn about Ahmadinejad the better he looks.

Netanyahu looks more like the trouble maker to me. The image below is of Colin Powell getting WMD in Iraq wrong. and Netanyahu at the U.N talking about Iran.

Wednesday, September 26, 2012

Friday, September 14, 2012

This was a very interesting video if you have 13 mins take the time to watch it. It has some ideas that i was unaware of as far as the petroleum dollar was discussed. There is a lot going on right now in the news about this issue and this can help you better understand what is happening. A few points that stood out the most to me was China and Russia's involvement in the Iran issue and all oil being US. The other issue that i felt was uncomfortable was level 3 of civil disobedience, but after he explained it further using the holocaust as the example it gave me chills. Please share this message. And if you already know about it i guess we should look to stage 2?

Wednesday, September 5, 2012

Here is a non political post about a couple of fun machines. I have always seen these on paper but never seem them actually working. Props to the builder. I drew one that worked by the marbles spinning around in the wheel. cool to see it actually some what works. for further reading see http://en.wikipedia.org/wiki/Perpetual_motion

Friday, August 31, 2012

Wednesday, July 11, 2012

Interesting that no one cares about this. I don't totally understand the implications of it as well. But i do know that things are getting worse not better. They try are reassure us that its ok Spain is sinking in debt but the good news is they got more debt to help with their debt problems. All the while i think we are having more issues here at home then we know. It's time to perform your own bank stress test.

Here is an image i found to help understand LIBOR

And here is more info as well

http://www.nytimes.com/interactive/2012/07/10/business/dealbook/behind-the-libor-scandal.html

Behind the Libor Scandal

A settlement between the British bank Barclays and regulators may be the first

in a series of cases against other banks that may have manipulated the Libor.

in a series of cases against other banks that may have manipulated the Libor.

The Libor

It is calculated for 10 different currencies and 15 borrowing periods. There are 18 banks that submit rates for the U.S. dollar Libor.

JUNE 27, 2012

Last month, Barclays paid $450 million to settle accusations that it had tried to manipulate Libor rates. Since then, its submitted rates have risen.

JULY 29, 2007

“Pls go for 5.36 libor again, very important that the setting comesas high as possible ... thanks.”

— Trader in New York to submitter

SEPT. 13, 2006

"Hi Guys, We got a big position in 3m libor for the next 3 days. Can we please keep the lib or fixing at 5.39 for the next few days. It would really help. We do not want it to fix any higher than that. Tks a lot."

— Senior trader in New York to submitter

DEC. 14, 2006

“For Monday we are very long 3m cash here in NY and would like the setting to be set as low as possible ... thanks”

— Trader in New York to submitter

3

2

1

What Barclays Did

What Is Affected by the Rate

How the Rate Is Set

Two Kinds of Manipulation

From 2005 to 2007, swaps traders often asked the Barclays employees who

submit the rates to provide figures that would benefit the traders, instead of

submitting the rates the bank would actually pay to borrow money.

The Libor is a benchmark interest rate that affects how

consumers and companies borrow money across the world. The rate is set by

the British Bankers’ Association (B.B.A.), an industry group in London.

British Bankers’ Association

The B.B.A. throws out the highest and lowest 25 percent of submissions and averages the remaining rates. This is the Libor.

Banks Submit Figures

Each weekday, leading banks around the world each submit a figure to the B.B.A. based on the rate at which they estimate they could borrow funds from other banks.

Derivatives

The Libor is often used to price financial instruments like swaps transactions and futures contracts. At least an estimated $350 trillion in derivatives and other financial products are tied to it.

Later, during the height of the financial crisis, Barclays submitted artificially low rates to give the impression that the bank could borrow money more cheaply and was healthier than it was.

Certain traders at Barclays coordinated with other banks to alter their rates as well.

Between 2005 and 2007, employees in Barclays’ trading units convinced employees responsible for submitting Libor rates to alter the bank's rates based on their derivatives trading positions to bolster their own profits.

Loans

To calculate interest rates, some lenders use the Libor as a base and add additional interest based on the borrower. When the Libor goes up, rates and payments on loans tied to it can rise as well.

Student Loans

About half of variable-rate private student loans are tied to the Libor.

Mortgages

Of the mortgages in the United States that are adjustable-rate, about 45 percent of prime mortgages and 80 percent of subprime have interest rates based on the Libor.

LIGHTER LINES REPRESENT RATES

SUBMITTED BY OTHER BANKS

CALCULATED

AVERAGE

RATE BARCLAYS

SUBMITTED

CALCULATED

AVERAGE

RATE BARCLAYS

SUBMITTED

LEHMAN

BROTHERS

BANKRUPTCY

Three-month

Libor rates

Three-month

Libor rates

Period

of chart

below

In 2008, Barclays submitted artificially low figures to deflect scrutiny about its health.

In October 2008, a Bank of England official questioned why Barclays’ submissions were high compared with other banks. After this, the Barclays rates fell closer to those of other banks. Barclays has released documents saying that some bank executives believed the official had instructed them to lower its rates, but the official has denied any improper actions.

5%

4

2

3

1

2012

2010

2008

2006

Feb.

Dec.

Oct.

2%

1

M

http://www.bitcoinmoney.com/post/26014446677/personal-bank-test

Here is a re-post from another blog i follow

Time To Perform Your Own Bank Stress Test

Things, around the globe, are starting to get real.

Last week and throughout the weekend the Royal Bank of Scotland inconveniencedthirteen million customers of NatWest, Ulster Bank and RBS. Customers were unable to use bill payment, ATMs and debit cards nor could they even transfer their funds to another account at the same bank.

With ATMs still not functioning into the weekend, bank and branch locations were then staffed on Sunday for the first time in the the bank’s history. Six days after the problems started, the ATMs were still not functioning.

While the official story is that the bank had a problem while performing an upgrade, rumors circulated that this was the result of cyberfraud or as a preventative measure to the threat of that (Update: and the rumors are even more plausible now that a massive fraud incident has since been exposed).

While the official story is that the bank had a problem while performing an upgrade, rumors circulated that this was the result of cyberfraud or as a preventative measure to the threat of that (Update: and the rumors are even more plausible now that a massive fraud incident has since been exposed).

Others suspect a different underlying reason: “How do you know that this is just a ‘computer glitch’ and not something more serious, like, for example, the bank being actually bust?” writes Karl Denninger, author for the Market-Ticker blog.

There has been a multi-week silent bank run in Greece, Spain and Italy and this week another country, Cyprus, requested a bailout for its banks. Regardless of whether or not it was just coincidence that this specific withdrawal problem occurred at the same time as these events, systemic bank insolvency around the world is something occurring right before our very eyes.

If your bank had a problem where suddenly no ATM debit card transactions were possible (or worse), how much of an impact would that have on you and your family?

If your bank had a problem where suddenly no ATM debit card transactions were possible (or worse), how much of an impact would that have on you and your family?

Or take the scenario where simply just a daily maximum withdrawal limit is imposed — at a level lower than you need. Would there have been any steps that you could have taken in advance to prepare?

Regardless of your bank’s solvency, they simply do not and cannot prepare for a surge in the amount of cash withdrawals. Already there are anecdotes telling of banks not allowing withdrawals exceeding an amount in the range of two thousand dollars (and even lower levels with funds in savings accounts). RBS wouldn’t be the first bank to invent an excuse or impose a more restrictive policy to deflect blame or hide the underlying reason their customers don’t have access to their funds.

Humans are wonderful procrastinators and we share the idiosyncratic belief that once we start to smell smoke that somehow we will be the lucky ones who can make it out the exit a step ahead before the crowd that might trample us. We can envision the steps for how we would proceed in such a scenario but we have never really practiced the methods to have even a clue if the steps might actually succeed.

Perhaps the RBS crisis provides the justification for us to prepare — to do a dry run.

Specifically, here is the challenge. Consider the scenario that your bank is no better than RBS and for the next seven days (at least) you and a good third of everyone around you will be denied access to your bank account — no checking, no ATM, no debit card, no online bill pay, and no wire transfers. Except for this scenario you happen to be exceptionally prescient and know that you have a few hours before this actually happens.

Do you, at this very moment, have several thousands of dollars of “available funds” at your bank? Does your bank serve requests for larger cash withdrawals or will they take the opportunity to educate you on some policy that they have instituted where even a $2,500 USD withdrawal request will not be honored in full?

Do you know for sure? Have you ever tried? Shouldn’t today be the day you find out?

Some have made it their life’s mission to plan for much worse drastic changes than just banking disruptions, and others have been prepared for all contingencies for quite some time. Most of us have not even begun to consider such situations.

The funds you withdraw today can simply be re-deposited right back into your bank account following this test (we don’t want to trigger a bank run), so it isn’t like today is the day you have to figure out what to do with a huge wad of cash (and possibly expose yourself to risks to your personal safety).

Going through this exercise will help you though to know just how perilous the situation is so that you can start considering how to prepare accordingly.

Just coming to the realization of how unprepared we are is something stressful in itself.

Previous Post - Twitter: @BitcoinMoney

Tuesday, May 8, 2012

a Repost from the globe and mail Rob carrick

All young adults who think they’re getting a raw deal in today’s economy, let me tell you about how it was back in my day.

In 1984, my final undergraduate year of university, tuition cost more or less $1,000. I earned that much in a summer without breaking a sweat.

When I went looking for a new car in 1986, the average cost was roughly half of what it is now. It was totally affordable.

I had it easier than today’s twentysomethings, and I have no problem saying so. But quite a few others can’t see what all the fuss is about when it comes to the financial concerns of today’s young adults.The average price of a house in Toronto back in 1984 was just over $96,000. I wasn’t buying just then, but it’s worth noting that the average family after-tax income back then was close to $50,000. Buy a first home? Easy to imagine for new graduates of the day.

This became clear as responses poured in to last week’s columntying the Quebec student protests to the financial challenges faced by people who are trying to make the jump from college and university into the work force.

Some responses were heartfelt, like the one from a 78-year-old gentleman who said he grew up “in abject poverty on a farm” and worked to pay for his education. But other comments reflected a view that today’s young adults should just grow up.

My sense is that’s what they’re trying to do. But it’s tougher out there than some of you might know.

After earning a three-year BA (majoring in political science) at York University in Toronto back in 1984, I landed a summer job as a copy editor at The Canadian Press, the national wire service. I earned enough to spend a year in Ottawa earning a bachelor of journalism degree at Carleton University. I had to work the Christmas holidays at CP to top up my savings, but I was financially self-sufficient and incurred zero debt.

Today, financial self-sufficiency is impossible without taking breaks from school to work. The Bank of Canada’s handy inflation calculator tells us that my $1,000 tuition back in 1984 would cost $2,028 today if it increased just by the inflation rate annually. But according to Statistics Canada, the latest read on average tuition fees is $5,366.

In Ontario, the minimum wage is $10.25. A student who puts in a 40-hour work week for 12 weeks would stand to make about $4,900. That’s a sizable shortfall on tuition, never mind the cost of student fees, books and living expenses. As a parent of an 18-year-old heading to university out of town next year, I can tell you that budgeting $18,000 to $20,000 per year is prudent.

Buying a house is another point where the experience of older Canadians is unlike what today’s younger generation faces. Canadian Real Estate Association data show the average national price of a home in mid-1984 was $76,214. If houses kept up with inflation – and that would be a pretty good result all on its own – the average house would now cost $154,587. In April, the actual average was $369,677.

That’s an annualized gain of 5.8 per cent across the country. In cities like Toronto and Vancouver, the yearly increases are even more pronounced.

House prices themselves are an abstract number – the real question is how affordable a home is. Data from a 2011 Conference Board of Canada study on income inequality shows the average family after-tax income in 1984 was $48,500. In 2009, the latest date included in the study, income levels had risen to $60,000. In 1984, a house might have cost a family 1.6 times its annual income. Today, we’re looking at a multiple of something around six.

Not everything is more expensive for today’s young adults – mortgage rates were in double digits back in 1984 (but then again so were savings rates), and cars have pretty well risen in price along with inflation. And not everything is worse, at least on the surface. Today’s headline unemployment rate of 7.2 per cent beats the rate of almost 12 per cent back in the mid-1980s. Look deeper into those numbers and you find a youth unemployment rate of 18 per cent back then and 13.9 per cent today. Young adults haven’t benefited nearly as much as the overall population from declining unemployment trends.

Back in my day? Economically speaking, life was easier for the young adult.

______

THOSE WERE THE DAYS

Globe and Mail personal finance columnist Rob Carrick completed his undergrad degree back in 1984. Here’s a look at how housing prices have changed since then. House price gains in excess of inflation over a period of time make it harder for new buyers to get into the market.

| Region | Average Price 1984 | Price Today If Homes Had Risen by the Inflation Rate Since 1984 | Actual Average Price Today |

| Canada | $76,214 | $154,587 | $369,677 |

| Vancouver | $116,444 | $236,187 | $761,742 |

| Calgary | $94,154 | $190,976 | $409,750 |

| Toronto | $96,078 | $194,878 | $504,117 |

| Montreal | $66,116 | $134,105 | $318,400 |

| Halifax-Dartmouth | $71,950 | $145,939 | $272,599 |

Source: Canadian Real Estate Association, Bank of Canada inflation calculator

Subscribe to:

Posts (Atom)